Check the background of your financial professional on FINRA's BrokerCheck.

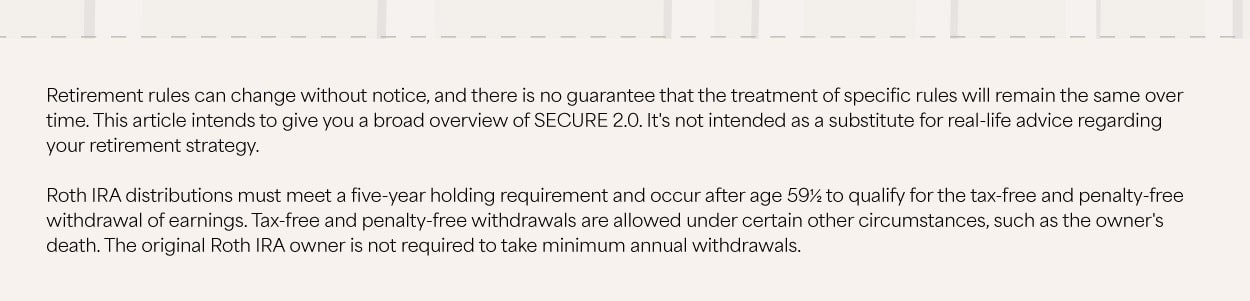

The content is developed from sources believed to be providing accurate information.

The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals

for specific information regarding your individual situation. Some of this material was developed and produced by

FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named

representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and

material provided are for general information, and should not be considered a solicitation for the purchase or

sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Copyright 2024 FMG Suite.

Securities and advisory services offered through Independent Financial Group, LLC (IFG), a Registered Investment Adviser. Member FINRA/SIPC. Epstein & Kolacz Wealth Management and IFG are unaffiliated entities. No investment strategy can guarantee a profit or protect against loss.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Broker-Dealer Privacy Policy: https://ifgsd.com/privacy-policy/

Licensed to sell securities in the following states: TX, AL, AK, CA, FL, IN, LA, OH, MN, NM, NY

Information provided is from sources believed to be reliable however, we cannot guarantee or represent that it is accurate or complete. Because situations vary, any information provided on this site is not intended to indicate suitability for any particular investor. Hyperlinks are provided as a courtesy and should not be deemed as an endorsement. When you link to a third party website you are leaving our site and assume total responsibility for your use or activity on the third party sites.